Table of Contents

ToggleIs banking at a breaking point, or a turning point?

As 2025 kicks off, the banking sector faces a tough reality. Profitability is under pressure, cost-to-income ratios are high, and price-to-book values aren’t bouncing back.

For over a decade, banks have battled the aftershocks of the 2008 crisis, relentless regulations, low interest rates, and cutthroat competition. Now, the gap between those that adapt and those that fall behind is only widening.

But amidst the challenges, one force is rewriting the rules: AI.

From reshaping operations to rethinking business models, AI isn’t just an efficiency booster—it’s a necessity. Banks that embrace artificial intelligence will drive stronger financial outcomes while staying ahead of risk and compliance demands, transforming financial services in the process.

The question is, who’s ready to make the shift?

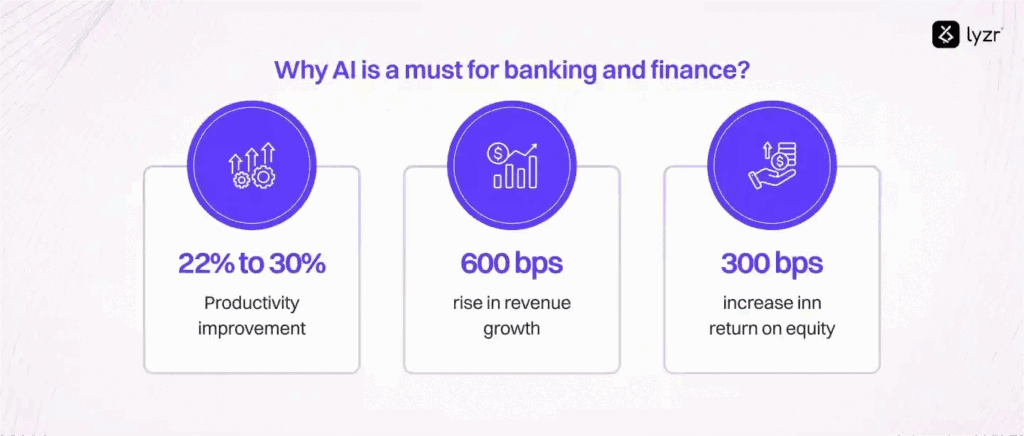

Why AI is a must for banking and finance?

Banks are using generative AI and machine learning to cut costs, fight fraud, and give customers a better experience, transforming the banking industry.

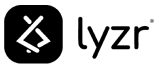

And it’s not just talk—the numbers prove it. McKinsey says AI could add $200 billion to $340 billion a year to banking, mostly by making things more efficient. Citi goes even bigger, predicting a $2 trillion boost in profits by 2028.

AI also helps reduce operational costs by automating processes and improving productivity. AI also enhances customer engagement by delivering personalized experiences, improving satisfaction through innovative tools and services.

And it’s already happening.

Fraud prevention? Barclays’ AI spots and stops fraud in real time.

Better customer service? Bank of America’s AI assistant, Erica, has handled over 1.5 billion conversations, cutting wait times and making banking easier. Data collection is crucial in improving AI prediction accuracy and mitigating bias, ensuring responsible AI usage and rectifying potential issues before impacting customers.

AI adoption is reshaping the financial services industry, driving innovation and enhancing operational efficiency.

So what’s stopping you from getting started?

Roles that benefit the most from AI in banking and finance

Front Office Roles (Customer-Facing)

- Tellers & Loan Interviewers: AI-driven automation is handling routine transactions, allowing staff to focus on complex customer interactions. Chatbots and virtual assistants are enhancing service, while fraud detection tools ensure security.

- Financial Advisors & Credit Analysts: AI augments decision-making by providing deeper insights into customer financial behavior, risk assessment, and personalized recommendations.

- Sales Agents & Market Analysts: Predictive analytics help identify market trends, optimize product offerings, and improve client engagement strategies. AI enhances customer engagement by delivering personalized experiences, transforming how financial services interact with clients.

Middle & Back Office Roles (Operations & Support)

- Bookkeeping, Accounting, & Auditing Clerks: AI automates data entry, reconciliations, and compliance checks, reducing errors and boosting efficiency.

- Financial Examiners & Investment Analysts: AI assists in analyzing large datasets, improving regulatory compliance, and identifying investment opportunities faster. It aids in effectively analyzing large volumes of financial data to identify risks in real-time, allowing for more efficient and continuous auditing practices within financial institutions.

- Office Clerks & Supervisors: Routine administrative tasks are automated, freeing up time for strategic and supervisory duties.

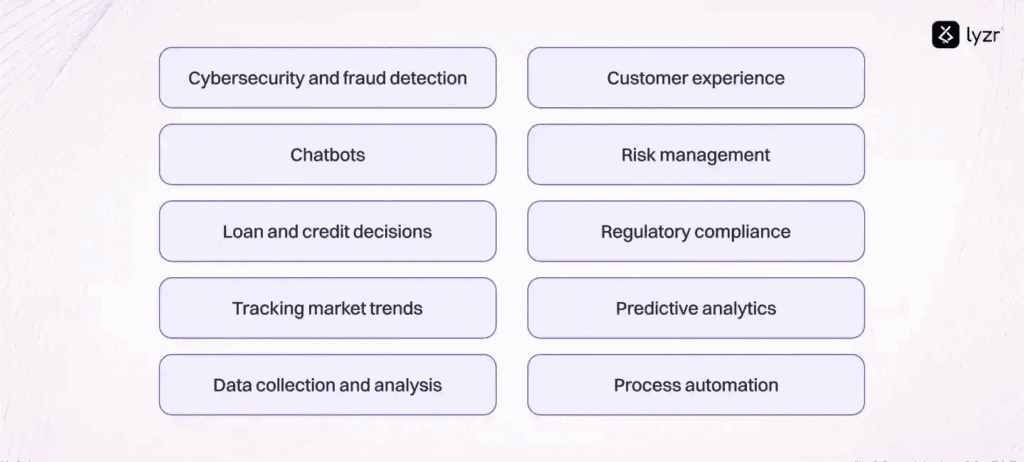

What are the applications of AI in Banking & Finance?

1. Know Your Customer (KYC) and Fraud Detection

KYC is both a regulatory necessity and a smart business practice. AI simplifies and speeds up the process, making it more efficient.

- Efficient Document Checks: Verifying documents is a crucial part of KYC. AI can quickly scan, validate, and organize documents, ensuring fast onboarding while maintaining compliance.

- Spotting Suspicious Patterns: AI can monitor transactions for unusual behavior. For example, if a customer suddenly transfers a large sum abroad, AI can flag it as potential fraud and notify the team for further investigation.

- Enhanced Live Verification: AI can compare a live video or selfie with stored ID photos, adding an extra layer of security while making the process more convenient for customers.

- Real-Time Data Updates: People’s personal details change over time. AI can remind customers to update their information, helping banks stay compliant and maintain up-to-date records.

2. Checking and Savings Accounts

AI transforms these traditional banking products into smart financial tools that go beyond simple storage.

- Smart Spending Insights: AI can analyze spending patterns, categorize transactions, and provide budgeting advice, giving your banking app a competitive edge by helping users manage their finances more effectively.

- Advanced Anomaly Detection: Imagine a system that learns a customer’s spending behavior over time. AI can detect red flags such as purchases at unusual hours, spending an entire week’s budget in a new online store, or frequent requests for transaction verifications, all of which may indicate unusual activity.

- Predicting Future Spending: Budgeting is often recommended for financial stability, but it’s hard to stick to. AI can help by forecasting a user’s balance at the end of the month based on recurring expenses and typical spending patterns, providing more realistic insights for financial planning.

3. Credit Cards

AI enhances traditional banking products by making them smarter and more adaptive to users’ needs.

- Context-Aware Spending Analysis: AI analyzes card transactions in relation to real-world events, understanding the context. For example, if spending spikes while you’re on vacation, AI recognizes this and avoids false fraud alerts while still monitoring for any suspicious activity.

- Automated Savings with Round-Ups: AI can automatically round up purchases to the nearest dollar (or $10) and transfer the difference into a savings account. Over time, AI can adjust the saving rate based on spending habits and set saving goals, helping users save more efficiently.

- Adaptive Card Locking: AI can predict when you’re less likely to use your card—such as during sleep—and auto-lock it to prevent unauthorized use. If a genuine transaction occurs during those hours, the system learns and adjusts to prevent future lockouts.

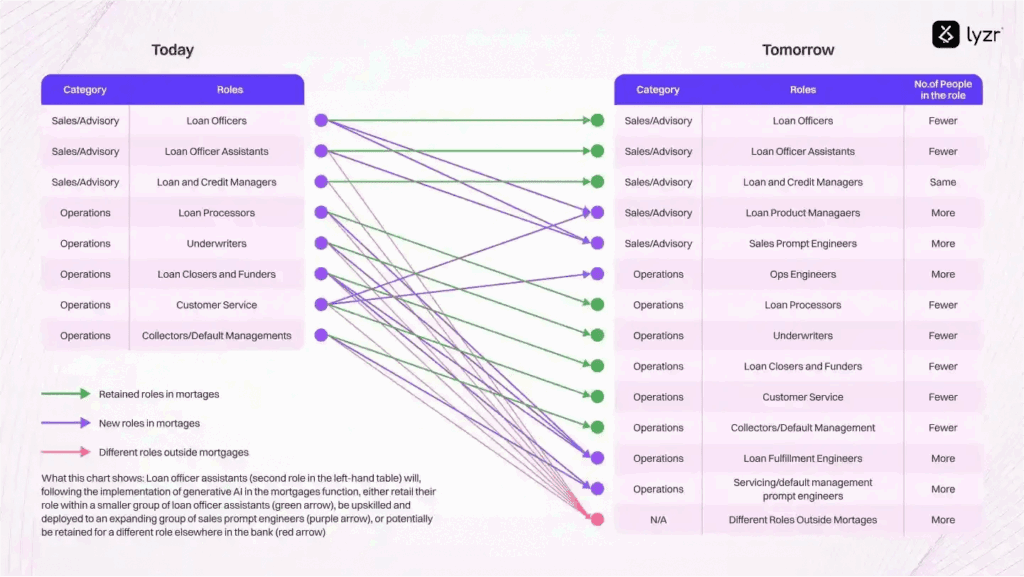

4. Loans and Mortgages

With AI, financial institutions can provide a smoother, more informed borrowing experience, increasing chances to get loans even without great credit history and protecting lenders from malicious users.

AI also plays a crucial role in credit decisions by providing deeper insights and ensuring transparency and fairness, addressing concerns over algorithmic bias and regulatory compliance.

AI is reshaping how banks assess credit and handle loans, making processes smarter and more efficient.

- Holistic Credit Scoring: AI looks beyond just loan and credit history to evaluate creditworthiness. It can factor in shopping habits, online activity, and other behaviors to provide a more accurate picture of a person’s financial reliability.

- Instant Loan Approvals: No one likes waiting for approval. With AI, loan approvals can be nearly instant, improving customer satisfaction and driving more business through positive word-of-mouth both online and offline.

- Predicting Loan Repayment Issues: AI can identify early signs that a borrower might struggle to repay a loan—long before the borrower realizes it. This enables banks to reach out proactively and create a plan to prevent issues before they escalate.

- Eliminating Bias in Lending: Bias in loan decisions, whether intentional or not, can lead to unfair outcomes. AI can be trained to minimize these biases, ensuring that all applicants have an equal opportunity.

5. Investment Services

AI is transforming investment services, helping both new and experienced investors stay on track and make smarter decisions.

- Personalized Robo-Advisors: AI-driven robo-advisors go beyond basic advice—they adapt to each client’s financial goals and habits. This level of personalization fosters trust and encourages long-term loyalty to your bank or firm.

- Market Insights with Sentiment Analysis: AI analyzes news, social media, and financial forums to uncover valuable insights. Sharing this information with clients gives them a competitive edge and positions your service as a trusted source for market trends.

- Automated Portfolio Management: Manual portfolio adjustments are outdated. With AI, portfolios automatically rebalance based on market conditions, reducing human error and improving efficiency. This approach attracts investors who value modern, automated services.

Examples of financial institutions using AI

- Capital One: “Eno” was the first natural language SMS text-based assistant launched by a U.S. bank, providing customers with real-time financial insights and support.

- Bank of America: The chatbot “Erica,” introduced in 2018, has served over 10 million users. By mid-2019, Erica could understand nearly 500,000 variations of customer inquiries, making it a valuable tool for personalized banking support.

- JPMorgan Chase: JPMorgan Chase employs advanced fraud detection algorithms that analyze transaction data in real time. These algorithms help identify suspicious activities by comparing transaction details against known fraud patterns.

- Kensho: Kensho develops analytical tools used by major financial institutions like Goldman Sachs, Bank of America, Merrill Lynch, and JPMorgan Chase. These tools provide insights to improve financial decision-making through advanced analytics.

- Alphasense: Alphasense is an AI-powered search engine tailored for the finance industry. It serves clients like banks, investment firms, and Fortune 500 companies by utilizing natural language processing to analyze market trends and keyword searches.

These institutions invest in high-quality data collection practices to improve AI prediction accuracy and mitigate bias, ensuring responsible AI usage and rectifying potential issues before impacting customers.

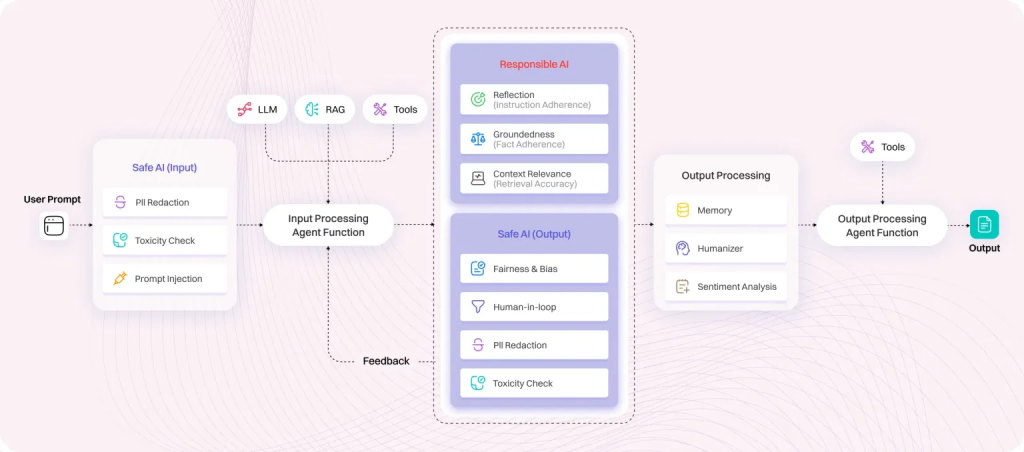

How Lyzr’s Enterprise AI solution reduces operational costs in banking and finance operations

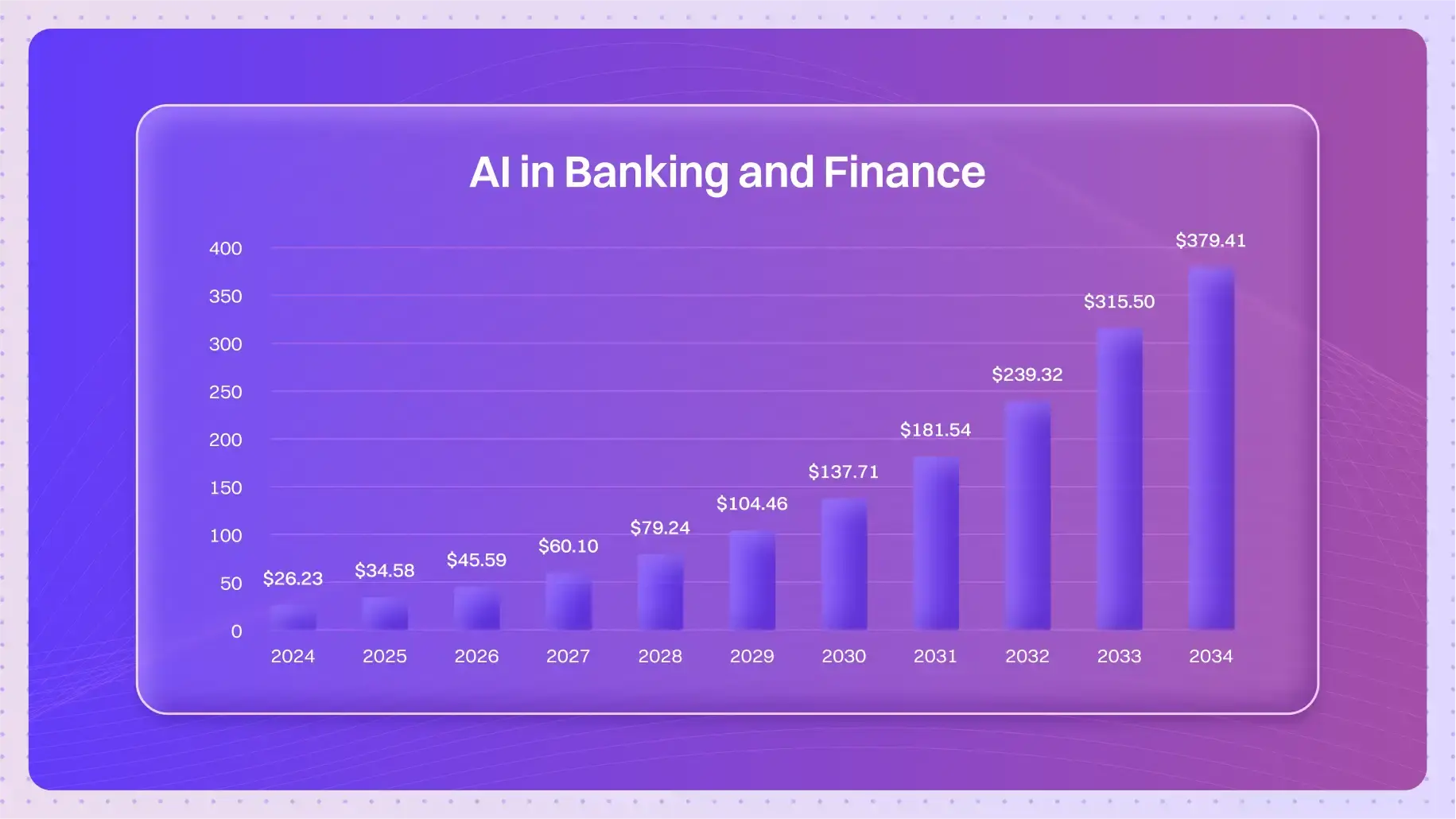

Lyzr’s enterprise AI solutions are transforming banking and finance operations by providing a suite of pre-built agents tailored to the industry’s specific needs through the power of artificial intelligence.

These agents automate routine tasks, enhance customer interactions, and improve operational efficiency. Additionally, Lyzr’s AI solutions enhance risk management by identifying and mitigating various risks, such as fraud detection, customer service, and compliance, saving banks from potential losses.

With lyzr you can either automate repetitive tasks and workflows with our no-code platform or choose from thousands of pre-built agents for immediate impact.

With our agents banks can streamline KYC, fraud detection, loans, and customer support with AI agents that ensure speed, accuracy, and compliance and the financial services industry can simplify expenses, reporting, and risk analysis.

Pre-Built AI Agents for Banking and Finance:

- Customer Service Agent: Lyzr’s AI Customer Support Agent for banking is a highly modular, multi-agent system designed to automate customer support across chat, email, and voice. Powered by 20+ customizable agents in the background, it manages up to 90% of routine queries, freeing human teams to focus on high-impact issues.

- Loan Underwriting Agent: Streamlines the loan application process by automating document verification, risk assessment, and decision-making, reducing approval times and enhancing accuracy.

- Fraud Detection Agent: Continuously monitors financial transactions for suspicious patterns, enabling real-time detection and response to potential fraud, thereby enhancing security and compliance.

Build your own agent or have a unique need? Come talk to us

Teller Assistant Agent

Lyzr’s Teller Assistant Agent improves in-branch banking by listening to live teller-customer interactions and surfacing relevant knowledge base articles, policy documents, and product details in real time. This helps tellers provide accurate responses quickly, reducing wait times and improving customer

How it works?

- The agent will listen to the conversation between the teller and the customer.

- The agent will proactively bring up the search results relevant to the conversation.

- The agent helps in quick search and reference material ensuring that the teller is able to answer the customer query instantly.

Regulatory Monitoring Agent

Lyzr’s Regulatory Monitoring Agent transforms the way banks and financial institutions stay compliant. By combining real-time regulatory tracking with Generative AI capabilities, this agent ensures teams are always informed and prepared to act.

The benefits?

- Faster Decision Making: Empowers teams to get answers on-demand, speeding up compliance workflows.

- Proactive Compliance: Enables teams to stay ahead of regulatory changes by automating discovery and interpretation.

- Reduced Legal Overhead: Minimizes reliance on manual review by legal experts, reducing compliance costs.

Claims Processing Agent

Lyzr’s Claims Processing Agent automates the complex task of verifying and validating insurance claims. From document analysis to eligibility decisions, it seamlessly identifies compliant claims, flags inconsistencies, and accelerates approvals, significantly improving efficiency, reducing manual overhead, and enhancing customer satisfaction.

The benefits?

- Improved Customer Experience: Enhances policyholder satisfaction through quicker, clearer communication and transparency.

- Highly scalable: Effortlessly handles increased claim volumes, easily adapting to evolving insurance standards and criteria.

- Operational efficiency: Eliminates repetitive, manual verification tasks, allowing insurance teams to focus on complex cases

Discover how Lyzr Agent Studio can transform your banking operations—try it today.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here