Table of Contents

ToggleThe AI insurance market isn’t just growing, it’s skyrocketing. Valued at USD 3.64 billion in 2022, the artificial intelligence market in insurance is projected to hit USD 35.77 billion by 2030, growing at an impressive CAGR of 33.06%, according to Data Bridge Market Research.

This isn’t just a trend; it’s a fundamental shift in how the industry operates.

AI agents are leading the charge, using advanced machine learning to analyze massive datasets, detect patterns, and make real-time decisions.

This real-world adaptability is helping insurers optimize workflows, lower operational costs, and minimize errors.

Whether it’s catching fraud before it happens or delivering personalized policy recommendations, AI agents are paving the way for insurance to be faster, smarter, and more customer-focused.

In this blog, we’ll explore the role of AI agents in insurance, diving into their benefits, practical uses, and how they’re shaping the industry’s future.

Why You Should Think of Shifting to Top AI Agents for Insurance in 2025?

Wondering why regulated industries like insurance are at the forefront of the AI revolution? Watch this short clip to understand the strategic importance:

1. Are Long Wait Times Driving Customers Away? They Don’t Have To with Improved Customer Satisfaction

Traditional service methods like IVR menus and long hold times often frustrate customers. AI agents resolve this by delivering instant, conversational support, thanks to natural language processing capabilities that allow them to understand and respond to customer queries effectively.

They eliminate the need for waiting, navigating complex menus, or repeating information, ensuring customers get fast and reliable help when they need it.

2. What About Routine Tasks? AI Agents Handle Them Effortlessly

Tasks like data collection, form filling, and answering repetitive questions can drain valuable time and resources, but AI tools handle them effortlessly. AI agents easily integrate with CRMs and databases to manage these processes, allowing human agents to focus on resolving unique or complex issues.

3. Can AI Agents Really Help Sell Better Policies? Absolutely

AI agents analyze customer behavior and preferences by analyzing customer data to suggest policies tailored to their specific needs. This personalized approach not only increases customer satisfaction but also drives policy upgrades and sales, helping businesses meet customer demands while boosting revenue.

4. Are They Cost-Effective? The Numbers Speak for Themselves

AI agents automate customer journeys, reducing manual workloads and cutting operational costs. By 2030, industry experts predict that adopting AI-driven solutions could save the insurance sector up to $400 billion, making them a smart and scalable investment.

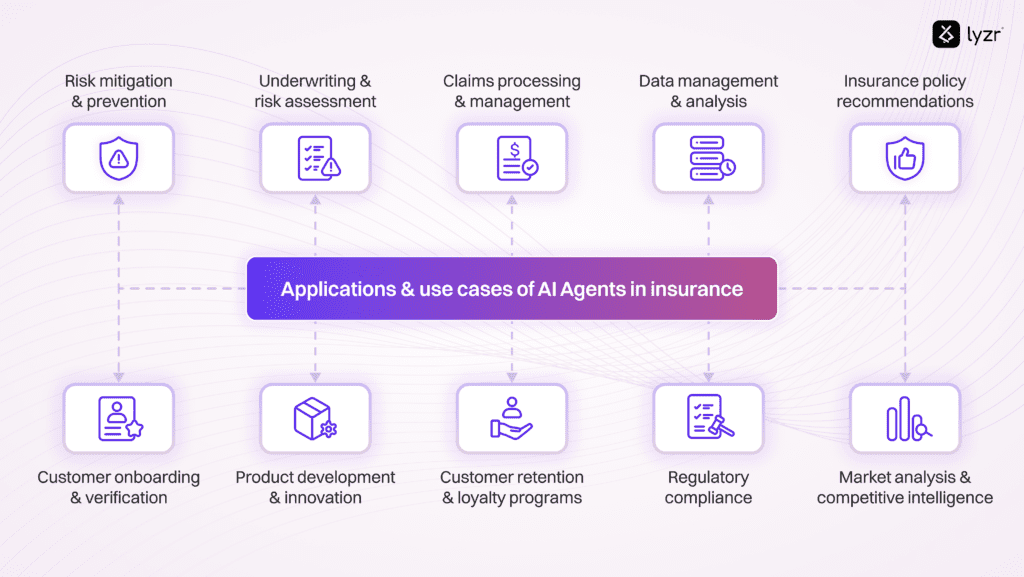

What are the top applications of AI agents in Insurance?

1. Claims Processing and Management

See for yourself how AI can transform claims processing in this quick demo:

What if claims didn’t take forever to settle? AI agents are transforming claims processing by automating assessments. Instead of waiting weeks for manual reviews, these agents analyze data from medical records, accident reports, and policy details to verify claims quickly.

By analyzing claims data, AI agents can also identify patterns and anomalies, which helps in detecting suspicious activities related to fraud. The result? Faster settlements with less back-and-forth.

How do insurers handle fraud better now? Fraudulent claims cost insurers millions, but AI agents are stepping up. Using machine learning to spot patterns and anomalies in claims data, they identify suspicious activity that could indicate fraud.

And the best part? These systems keep learning and getting better over time, saving insurers time and money while keeping premiums fair for honest customers.

2. Underwriting and Risk Assessment

Can AI Agents really improve risk assessments? Absolutely. AI agents dig into data that goes beyond the basics, think social media activity, credit scores, and even lifestyle habits, using advanced data analytics to create precise risk profiles. This level of detail helps insurers price premiums more accurately and manage risks effectively.

How do they predict the unpredictable? AI agents use predictive analytics to spot trends in claims and risk patterns before they become issues.

For example, if certain types of accidents are on the rise in a region, insurers can proactively adjust their strategies. It’s risk management on a whole new level.

3. Policy Management

Tired of missing renewal deadlines? AI agents have that covered by analyzing data and renewal cycles to send timely reminders, ensuring policies stay active. This not only keeps customers protected but also improves retention rates for insurers.

What about issuing new policies? Gone are the days of lengthy paperwork. AI agents automate everything from data entry to document generation, speeding up policy issuance while reducing errors. It’s a win-win for customers and insurers.

4. Product Development and Innovation with Advanced Data Analytics

How can AI create better insurance products? By analyzing market trends and customer behavior, AI agents identify what’s missing in the current offerings, enabling the insurance industry to develop products that truly resonate with customers.

For instance, they might highlight the growing need for microinsurance or usage-based insurance, allowing insurers to innovate and meet evolving customer demands.

Top AI Agents in Insurance: A Comprehensive Guide

Streamlining legitimate claims is one part of the puzzle, but what about protecting the system from illegitimate ones? Fraud is a multi-billion dollar problem that affects premiums for everyone. This is where the next specialized AI agent steps in, acting as a digital detective to safeguard assets.

1. Claims Processing Agent

Dealing with claims can feel endless, but AI-powered claims agents streamline the claims process, cutting through the delays.

Lyzr Claims Processing Agent swiftly analyzes documents and evidence, offers instant feedback, and even issues payments in minutes. Think about how much smoother it’d be to handle claims without the usual back-and-forth.

2. Fraud Detection Agent

Fraud drains billions from insurers annually. That’s where fraud detection AI steps in, spotting issues before they escalate.

Shift Technology Fraud Detection Agent scans countless data points, flagging suspicious activity in real-time. Its machine learning capabilities ensure it gets smarter, assisting insurance agents in saving resources and maintaining fairness.

3. Risk Assessment Agent

Why settle for broad risk assessments when AI can make it personal?

For example: Zego Risk Assessment Agent analyzes driving habits and location data using large language models, tailoring premiums to their actual risk profiles. No generic policies just fair, data-driven coverage.

4. Customer Support Agent

Insurance questions never clock out, but neither does AI customer support.

For instance, Lemonade Customer Support Agent delivers 24/7 assistance for policy details and claim updates, supporting the insurance agent in providing better experiences and stronger customer loyalty. Instant answers mean better experiences and stronger customer loyalty.

5. Underwriting Agent

Traditional underwriting can be slow and biased. AI changes that by focusing on the data.

Cuvva Underwriting Agent reviews applications in seconds, pulling from a range of data points to ensure fair pricing and eliminate biases. That’s underwriting done right.

6. Personalization Agent

Customers want coverage that reflects their unique needs. AI personalization agents make it happen.

Acko Personalization Agent analyzes customer behavior to suggest tailored policies and coverage options. The result? Better engagement and long-term loyalty.

7. Policy Management Agent

Managing policies doesn’t have to be overwhelming. AI agents make it straightforward.

Policygenius Policy Management Agent helps clients review coverage, update details, and get renewal reminders through an intuitive platform. Staying on top of insurance has never been easier.

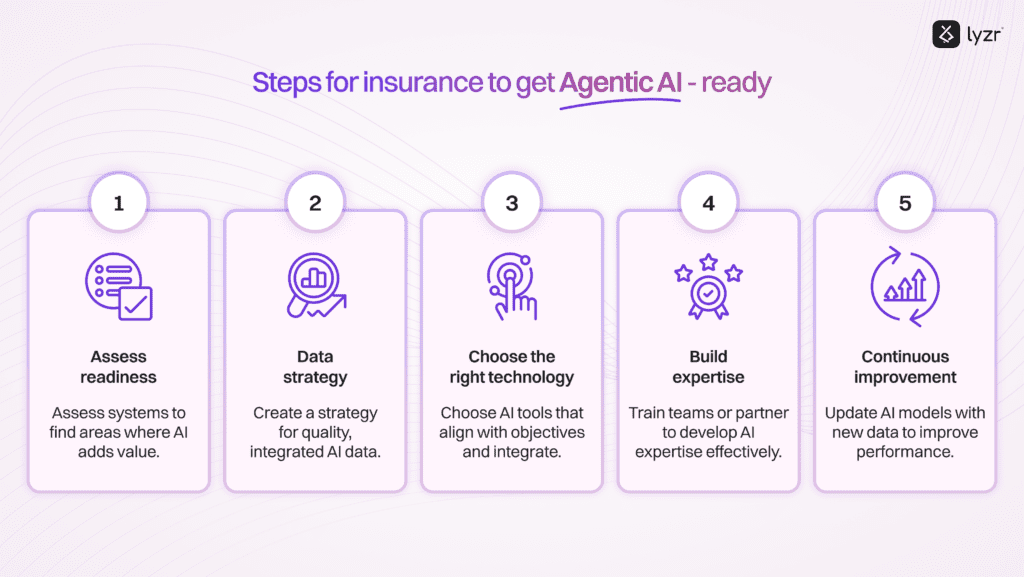

What are the Best Practices for Adopting AI for Insurance Agents?

Now that you know the top ai agents for insurance, check out what should be the best practices for adopting them

1. Pick the Right AI Agent, Because One Size Doesn’t Fit All

Not all AI agents are created equal. If your goal is to manage complex, personalized conversations, generative AI is your go-to, handling varied queries with human-like precision.

For simpler tasks like answering FAQs or managing repetitive processes, a rule-based model works just fine. Want the best of both worlds? A hybrid approach blends flexibility with accuracy, catering to different customer needs without missing a beat.

2. Feed It the Right Information

AI agents rely on accurate data to perform well. Integrating them with a robust, updated knowledge base ensures they can access details about policies, claims, and compliance regulations.

For insurance companies, this means connecting agents to a detailed repository of offerings and requirements. Regular updates keep responses accurate and aligned with evolving customer expectations and industry standards.

3. Know When to Involve Humans in the Loop

While AI agents handle many tasks efficiently, some cases require a human touch, especially complex claims or sensitive matters. Establishing a seamless handoff process ensures customers receive the right level of support when needed.

This balance between AI and human involvement builds trust and ensures customers feel valued, no matter the complexity of their query.

4. Keep Customer Data Locked Up Tight

Insurance data is sensitive, it’s your responsibility as an insurance agency to keep it that way. AI agents should come with top-notch security features, from data encryption to strict access controls. Compliance with regulations like GDPR and HIPAA isn’t just a checkbox, it’s a trust builder. Regular updates and transparent communication about data usage show customers that their information is in safe hands.

5. Monitor, Learn, and Improve Continuously

AI agents aren’t a “set it and forget it” solution. Regularly track performance metrics like resolution rates and customer feedback to fine-tune their responses.

Customer insights are gold, use them to plug gaps, improve experiences, and keep your AI on its toes. The result? A smarter, sharper AI that grows with your business.

To see how these principles are applied in a highly regulated industry, check out our Banking Playbook. It offers a practical guide for scaling agentic AI from pilot to production.

How can Lyzr Agent Studio help you build the best AI agents for insurance?

Lyzr Agent Studio makes building secure, reliable AI agents seamless, integrate them into your

workflows, automate tasks, and customize them to fit your business goals.

1: Define Your Agent: Give your agent a name and purpose. Choose your preferred LLM provider and model, then outline the instructions or idea to get started.

2. Set the Direction: Shape the output. Define what you expect from your agent, ensuring responses are accurate and in the format you need.

3. Seamless integrations: Run your agent, ask questions, and evaluate its responses. Refine the prompts as needed for perfection.

4. Rapid Development and Testing: Launch your agent as an app on Lyzr’s Marketplace and let others discover, access, and benefit from your creation.

Conclusion: The Future of Insurance is Intelligent

The shift towards AI agents in insurance is no longer a futuristic concept, it’s the current reality. We’ve moved beyond simple automation to a new era of intelligent, adaptive, and hyper-personalized service. From instantly processing claims to predicting risk with pinpoint accuracy, AI agents are fundamentally reshaping the industry’s value chain.

Ready to get started? Try out our platform now

Frequently Asked Questions (FAQs)

Best AI for insurance agents starting out?

For most agencies, starting with a Claims Processing Agent or a Customer Support Agent offers the most immediate impact. They tackle high-volume, repetitive tasks for quick wins in efficiency and customer satisfaction. Platforms like Lyzr AI make it easy to start with one of these foundational agents and then scale your AI capabilities as your needs grow, freeing up your human team almost instantly.

Is using AI for insurance underwriting ethical?

Yes, when done correctly. Reputable AI agents are designed with “privacy by design” principles. They use anonymized or aggregated data for trend analysis and are programmed with strict rules to ignore protected personal information. All data processing is done in compliance with regulations like GDPR, ensuring that risk profiles are created ethically and without illegal bias.

When does insurance AI need a human?

A seamless handoff is triggered by pre-defined rules. An AI agent will escalate a claim to a human if the case involves a high-value payout, contains conflicting information, flags a high potential for fraud, or if the customer explicitly requests to speak with a person. This ensures efficiency for standard cases and expertise for complex ones.

Insurance products created by AI?

A great example is usage-based insurance (UBI) for vehicles. AI agents analyzed telematics data (driving habits, times, locations) and identified a market for low-risk customers who were being priced using traditional, broad metrics. This insight allowed insurers to create fairer, personalized policies that reward safe driving.

Build vs. buy AI for insurance?

The primary advantage of building is customization. Off-the-shelf solutions are generic and can be limiting. Using a no-code platform like Lyzr AI, you can build your own agent to perfectly match your agency’s workflows, policy types, and brand voice. This allows for direct integration with your existing CRM and databases for a much more powerful and seamless operation.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here